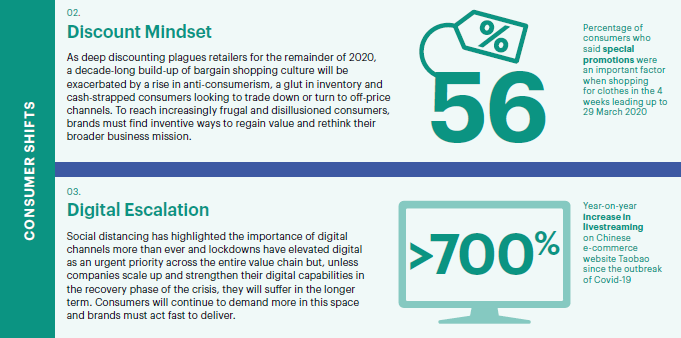

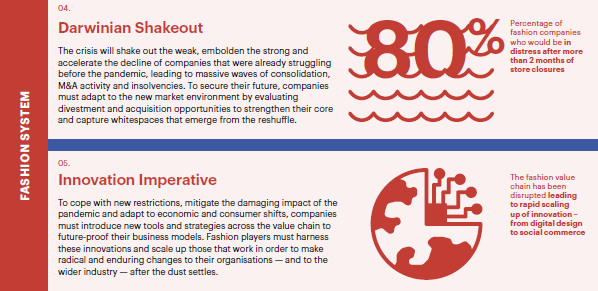

Before the pandemic hit our global economy, the fashion industry was already facing an evolutionary period punctuated by brick and mortar store closures, dying or empty malls, and the knowledge that our current supply chains and means of production were leaving heavy carbon footprints. And so we, as an industry, was already asking, "What next?" Little did we realize that we would be tasked with having to answer this question so soon but...now here we are and so, "What is next for the fashion industry in the face of the Coronavirus Pandemic?" The BOF/McKinsey report outlines that the fashion and apparel industries were already experiencing a steep decline before the COVID 19 pandemic. The report states that the average market capitalization of apparel, fashion, and luxury players dropped almost 40 percent between the start of January and March 24, 2020. We know retailers, particularly brick and mortar operations, were already struggling due to an increase in online and social media shopping. And now, with only non-essential retailers, such as grocery stores, drug stores, and hardware stores, open, then we can easily surmise that this trend will continue to accelerate...and retailers will need to close those stores with low foot traffic and allocate more money in redefining the shopping experience to continue to excite and draw consumers to their stores. But even outside consumers growing lack of interest in shopping (in general), consumers had already become, before the pandemic, increasingly less interested in participating in the excesses associated with the fashion and luxury sectors. Consumers had already indicated a desire for apparel businesses to shift their focus to providing apparel that was sustainable and/or produced by supply chains that minimized waste, such as upcycling processes, and instead of producing and selling fast, disposable fashion...to create high quality, mindful products. These same consumers, before the pandemic, had indicated the willingness to pay premium for these types of products. Some of what I've stated is highlighted in the attached State of Fashion as well as outlined below...and much of it lines up with what many of us were already saying...even before the COVID 19 pandemic. So...The quick nutshell is this: We know now that due to the contraction our economy will experience due to this crisis, then we will need to creatively explore how to provide high end products at budget pricing. An increase in personalization, micro-production, end-to-end production, athleisure, and a reinvention of work wear tailored towards remote work and a resurgence in special occasions dress as stepping out will be synonymous to dressing up are additional trends that should be considered as part of the future of fashion post Covid 19. Brands and retailers will need to make more seamless connections with technology such as the use of 3D and virtual reality and draw consumers into their physical stores with experiences that extend the online consumer experience. I've included additional insights regarding the BOF/McKinsey State of Fashion Report below. Take a moment to read and share your thoughts. Survival Instincts, to summarize, revolves around businesses understanding what structurally and strategically works for them and implementing tools and resources that maximizes their strengths and creates new opportunities. In addition, businesses will need to define their weaknesses and make decisions that either remove and/or minimize these weaknesses. For example companies will need to ask, "Does the current organizational structure truly reflect business needs or future goals?" Due to the current crisis, many companies are exploring ways to meet their consumer needs using remote, online, and or virtual means...if so, then does your current organizational structure in terms of human, technology, and communication support this strategy? If not, then now is the time to shore up this weakness...not in terms of parroting competition but in ways that will allow your organization to be the next market leader. Another example...a simple one...but hopefully effective...let's say you are a t-shirt producer and due to the changing work culture, you see a rise in the purchase of t-shirts. You may produce other items, such as dresses or outerwear, but your core business is t-shirts. An upsurge in the purchase of t-shirts should become your impetus to shift your resources from dresses and outerwear to t-shirts...and to not only meet the demand, but to begin to redefine why a consumer would purchase your t-shirts over the competition....is it because you can provide made to order, made to measure, superior fit, high quality, unique design? You have to understand your consumer and the market in order to survive the socio-cultural shifts that have arrived. In addition, you will need to also answer the question of what tools and/or additional resources will I need to employ to effectively meet this new demand. The next two trends posited by the BOF/McKinsey report deals with changing consumer behavior...interestingly enough, these are also not new trends, but rather accelerated behavior patterns due to the pandemic. I hesitate to agree with the idea that there will be a definitive rise in anti-consumerism for the following reasons that consumers' will more likely be ready to spend their discretionary income once respective economies begin to rebound...and the issue is less about consumer spending and more about "what" and "where" exactly will consumers want to spend their dollars. In answer to this question, I see consumers spending money on home electronics such as televisions, computers, gaming systems, office furniture, home security systems, as well as an increase in allocated dollars in home delivery services....just to name a few. Consumers will also continue to shop for apparel, but apparel that is geared towards the increased time now spent at home such as athleisure, loungewear, sleepwear, and I believe a new category geared specifically towards remote working will emerge. I do agree that consumers will be more mindful of how their dollars are spent and who receives those dollars. Consumers will look for value rather than discounts and purchase with purpose with companies that reflect their personal values. The final points posited by the report harkens back to the evolutionary period we were already experiencing as an industry...rather than survival of the most fit, survival will be contingent on the most connected. Either in terms of technological tools used to create more seamless development to production processes, the use of data intelligence to make business decisions connected to the current climate experienced by businesses and their consumers, real viable connections between industry members...whether that be direct or indirect members, and last but not least extending our understanding of the supply chain. We often speak of collaboration, but we will need to stretch this concept to include partnerships that extend supply chains and build a network that provides products truly driven by consumer demand...informed by business intelligence data. It may not just look like fabric and garment producers, but also working with tech companies that can address how to produce raw and finished goods in a quick and efficient manner...that most importantly reduces our carbon footprints. As we move towards a more dynamic process of providing value-driven goods to consumers, we will also see increased innovation within the industry. In order for this happen then this means an industry led by enterprise systems that are connected beginning with pos data and supported via erp, plm, and cad software. We will not only need to be digitized, but we need to mine the data and make business decisions based on the collective information provided from these applications. There's is more to consider in the report attached. I welcome your thoughts and insight.

0 Comments

Leave a Reply. |

Eco|ConsciousContact Fashion SpeaksThank you, your message has been sent

Archives

April 2020

|

||||||

RSS Feed

RSS Feed